You’ve asked about a fascinating and profound topic: Smart Money Concepts (SMC). This isn’t just another trading strategy; it’s a completely new way of looking at the market. It’s an attempt to understand how the big financial institutions—the “Smart Money”—move the markets and how we, as retail traders, can learn to ride their waves instead of being swept away by them.

This guide is written in simple, straightforward language, just like one friend explaining something to another. There’s no complex jargon here, only the distilled essence of experience and knowledge. Let’s begin this journey to uncover the market’s hidden secrets.

The Great Deception -The Sad Story of Retail Trading

Picture this. You’ve spent hours analyzing the charts. You spot a perfect “double bottom,” a classic bullish signal from your trading textbook. Your favorite indicator, the RSI, is also in the “oversold” territory. Everything you’ve learned from books and YouTube videos screams that this is a high-probability “buy” setup.

Full of confidence, you place a buy order. You set your stop-loss just below the double bottom, exactly as every guru teaches. The trade moves slightly in your favor, and you start to smile. But then… it happens.

Suddenly, a massive red candle appears out of no where. The price plummets, smashes through your stop-loss, and kicks you out of the trade. And then, as if by magic, it reverses and rockets upward, hitting the exact price target you had originally set.

Has this happened to you?

If you’ve been trading for any length of time, I’m willing to bet this has happened not once, but dozens of times. You are not alone. This is the story of 90% of retail traders. We try to console ourselves by calling it “bad luck,” “manipulation,” or “stop hunting.”

But what if I told you this isn’t a coincidence? It’s the market’s design. It’s a calculated game, and until you understand the rules, you will always be the prey.

Smart Money Concepts (SMC) is the key to understanding these rules.

Why Traditional Technical Analysis Fails Us

When we enter the world of trading, we’re given a set of tools:

- Support and Resistance: The magical lines where the price is supposed to turn.

- Trend Lines: The diagonal lines that show us the direction of the trend.

- Chart Patterns: Head and Shoulders, Double Tops, Flags, and Triangles—our version of astrology.

- Indicators: RSI, MACD, Moving Averages—the tools that supposedly tell us when to buy and sell.

The problem is, all these tools are used by 90% of traders. And if 90% of traders are losing money, shouldn’t we question if the tools themselves are flawed?

The truth is, all these tools are lagging. They tell us what has already happened, not what is about to happen. Even worse, they clearly mark the spots where millions of retail traders place their stop-losses and entry orders.

And that is where the Smart Money makes its move. To them, your stop-loss isn’t just a safety net; it’s liquidity. It’s the fuel that runs the market.

Who Are the Real Players? An Introduction to “Smart Money”

Who Exactly Is “Smart Money”?

Smart Money isn’t a single person. It’s a collective term for the institutions with enough capital and influence to move the market. These are:

- Major Banks (J.P. Morgan, Goldman Sachs)

- Hedge Funds

- Institutional Investors (Pension Funds, Insurance Companies)

They control trillions of dollars. When they enter the market, they don’t make ripples; they create the waves.

The Goal and The Problem of Smart Money

Their objective is simple: buy low and sell high. But their massive size creates a huge problem for them.

If you need to buy 10 million shares of a stock, you can’t just place a market order. Doing so would cause a massive spike in demand, driving the price up against you before your order is even filled.

Their challenge is finding a counterparty. To buy 10 million shares, they need someone willing to sell 10 million shares.

And who is that counterparty? It’s us—the retail traders.

Smart Money needs to engineer situations to trick us into buying when they want to sell, and selling when they want to buy. They do this by pushing the price to areas where they know our stop-losses and pending orders are clustered. This is called liquidity engineering.

When your “strong support” level breaks and your stop-loss is triggered, your “sell” order helps fill Smart Money’s “buy” order at a cheap price, right before they send the price in their intended direction.

It’s a harsh truth, but accepting it is the first step toward trading with SMC.

The Language of Smart Money-The Core Pillars of SMC

This is the most fundamental concept. In traditional analysis, we look for Higher Highs (HH) and Higher Lows (HL). SMC takes this a step further.

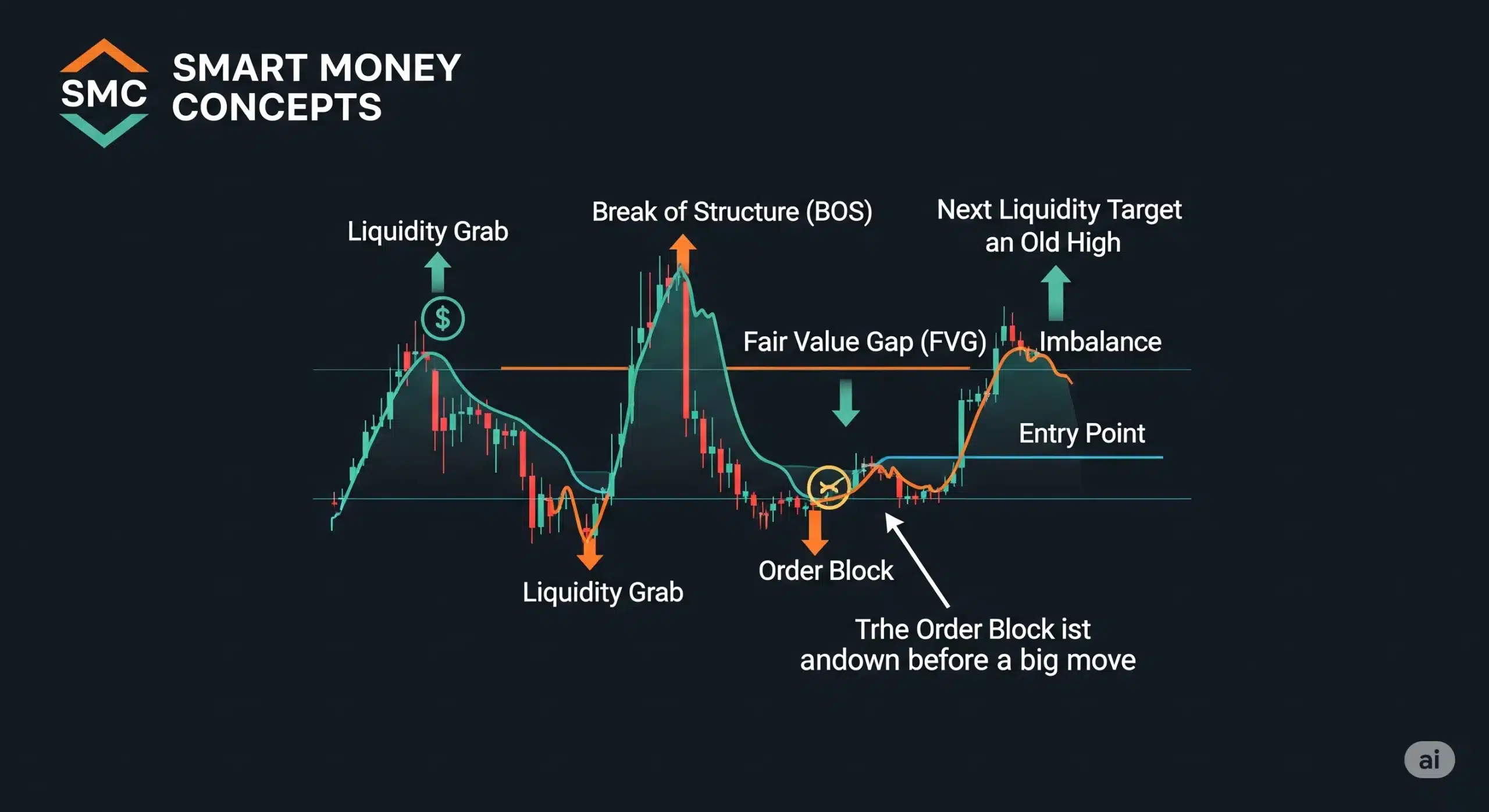

- Break of Structure (BOS): In an uptrend, when the price breaks above a previous Higher High to create a new one, it’s a BOS. In a downtrend, breaking a previous Lower Low is also a BOS.

- Change of Character (CHoCH): When the price breaks below the last Higher Low in an uptrend, or above the last Lower High in a downtrend, it’s the first sign of a potential trend reversal.

Liquidity: The Market’s Fuel

Liquidity is where large pools of orders are waiting. Smart Money is drawn to these pools.

- Old Highs and Lows

- Equal Highs and Lows

- Trend Lines

SMC traders identify these zones to anticipate price movements.

Order Blocks (OB): The Footprints of Smart Money

An Order Block is the last opposing candle before a strong, impulsive move that breaks market structure.

- Bullish Order Block: Last red candle before a bullish BOS.

- Bearish Order Block: Last green candle before a bearish BOS.

These are key areas where Smart Money likely placed their orders.

Fair Value Gaps (FVG) / Imbalances

An FVG is a three-candle pattern indicating inefficient price delivery and a potential area for future price action.

Premium vs. Discount: The Market’s Shopping Mall

Smart Money buys at a discount (below 50% of a range) and sells at a premium (above 50% of a range).

Putting It All Together — A Simple SMC Trading Plan

Higher Timeframe (HTF) Analysis

Identify the overall market structure and bias on higher timeframes (Daily, 4H).

Wait for Price to Reach Your POI

Be patient and wait for the price to move to your identified Points of Interest (HTF Order Blocks or FVGs).

Look for Lower Timeframe (LTF) Confirmation

On lower timeframes (15M, 5M, 1M), look for a Change of Character (CHoCH) after the price reaches your HTF POI.

Identify Your Entry

Find the Order Block on the LTF that caused the CHoCH. This is your potential entry zone.

Set Your Stop Loss and Take Profit

- Stop Loss: Placed below/above the LTF Order Block.

- Take Profit: Target the next significant liquidity pool.

The Psychology of an SMC Trader -Winning the Mental Game

- Patience

- Discipline

- Understanding Probability

- Leaving Your Ego at the Door

Conclusion: A New Beginning in Your Trading Journey

Smart Money Concepts offer a powerful lens through which to understand and trade the markets. By focusing on structure, liquidity, and institutional order flow, you can develop a more informed and strategic approach to trading.

READ ALSO: Complete Guide to Risk Management in Trading: Protect Your Capital Like a Pro

Disclaimer: This article is for educational purposes only and is not financial advice. While it may discuss Smart Money Concepts, understand that institutional players often seek retail traders as liquidity. All trading involves substantial risk. Always do your own thorough research before making any investment decisions..